do i have to pay taxes on fanduel winnings|Taxes : Tagatay We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa Download the EA app Learn about Origin Designed for speed. The fast, optimized platform makes it easier than ever to download and play. So jumping into your game takes less time and fewer clicks. Built to connect. Link your EA Account with your favorite gaming platforms to import friends lists and play together.

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes on Sports Betting: How They Work, What’s

PH2 · Taxes and Fanduel? : r/dfsports

PH3 · Taxes

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Sports Betting Taxes: How They Work, What's Taxable

PH7 · I won in FanDuel, do I pay taxes on winnings if I don't

PH8 · How to Pay Taxes on Sports Betting Winnings

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Do I Have To Report FanDuel Winnings On Taxes?

The National Home Mortgage Finance Corporation (NHMFC) ensures compliance with the Data Privacy Act of 2012 to protect the fundamental human right of privacy and .

do i have to pay taxes on fanduel winnings*******We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional . Tingnan ang higit paA Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. . Tingnan ang higit pa

Income Tax. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I don't because I .

Taxes and Fanduel? Ive seen websites indicating that if you make over $600 in a year that you'll be sent a form by the IRS. My question though is if you don't withdraw any money .Taxes Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, .

In short, the proceeds from a successful sports wager are taxable income, just like your paycheck or capital gains from investment income. While you can write off some gambling losses if you .

Fanduel operates under the guidelines of the Internal Revenue Service (IRS). They issue a 1099-Misc tax form for winnings over $600. However, if you win . Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, .do i have to pay taxes on fanduel winningsGenerally, any income received from gambling, including winnings from casinos, lotteries, sports betting, and online platforms like FanDuel, is considered taxable. The IRS . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on .

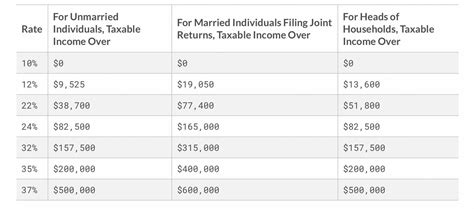

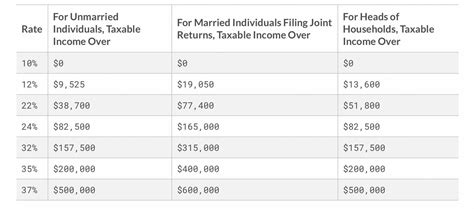

Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in which winnings resulting from a wager are . Do You Have to Pay Taxes on DraftKings, FanDuel, BetMGM, and Other Fantasy Sports Bets? . How Much Tax Do You Pay on Fantasy Sports Winnings? If you win more than $600 playing . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on . No, gambling winning and losses reporting did not change at all with the new tax code. Winnings have always been reportable and taxable and losses, up to the amount of winnings have always been deductible as part of your itemized deductions. If you do not have enough deductions in total to itemize, then you lose the deduction of .

While FanDuel winnings are generally considered taxable income, not all winnings may be subject to reporting depending on the amount won and the frequency of your gambling activities. Amount won: As mentioned earlier, the IRS has set a reporting threshold of $600 for gambling winnings. If your total winnings from FanDuel in a tax year exceed .

Winnings From Online Sports Sites Are Taxable. If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should also send both you .

How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel .Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through PayPal, the .

According to an IRS publication on the subject, if you win more than $5,000, the casino or sportsbook may be required to withhold 28% of your winnings. Illinois has a 4.95% flat state income tax rate, and this is the percentage that would be withheld at the state level. For lottery winnings, they withhold the 4.95% if you win $1,000 or more.do i have to pay taxes on fanduel winnings Taxes According to an IRS publication on the subject, if you win more than $5,000, the casino or sportsbook may be required to withhold 28% of your winnings. Illinois has a 4.95% flat state income tax rate, and this is the percentage that would be withheld at the state level. For lottery winnings, they withhold the 4.95% if you win $1,000 or more.

RPGM Completed Complete [Translation Request][HATOMAME] Bitch Familly on the Village [V1.01][RJ01135233] . F95zone is an adult community where you can find tons of great adult games and comics, make new friends, participate in active discussions and more! Quick Navigation.

do i have to pay taxes on fanduel winnings|Taxes